Sales Tax

Due to recent tax changes within the U.S., sales tax will now be charged on your purchase with monday.com if you are registered in the states listed below. Sales tax, a non-refundable tax, is determined according to the state average in addition to the local tax totaling between 5%-9%.

- Arizona

- California

- Connecticut

- Washington D.C

- Hawaii

- Kansas

- Massachusetts

- Michigan

- Mississippi

- New Mexico

- New York

- Ohio

- Pennsylvania

- Rhode Island

- South Dakota

- Tennessee

- Texas

- Utah

- Washington

- West Virginia

If you are registered as tax-exempt, please email us at support@monday.com with documentation attached to your email so we can follow up with our payment processor accordingly.

VAT Refund

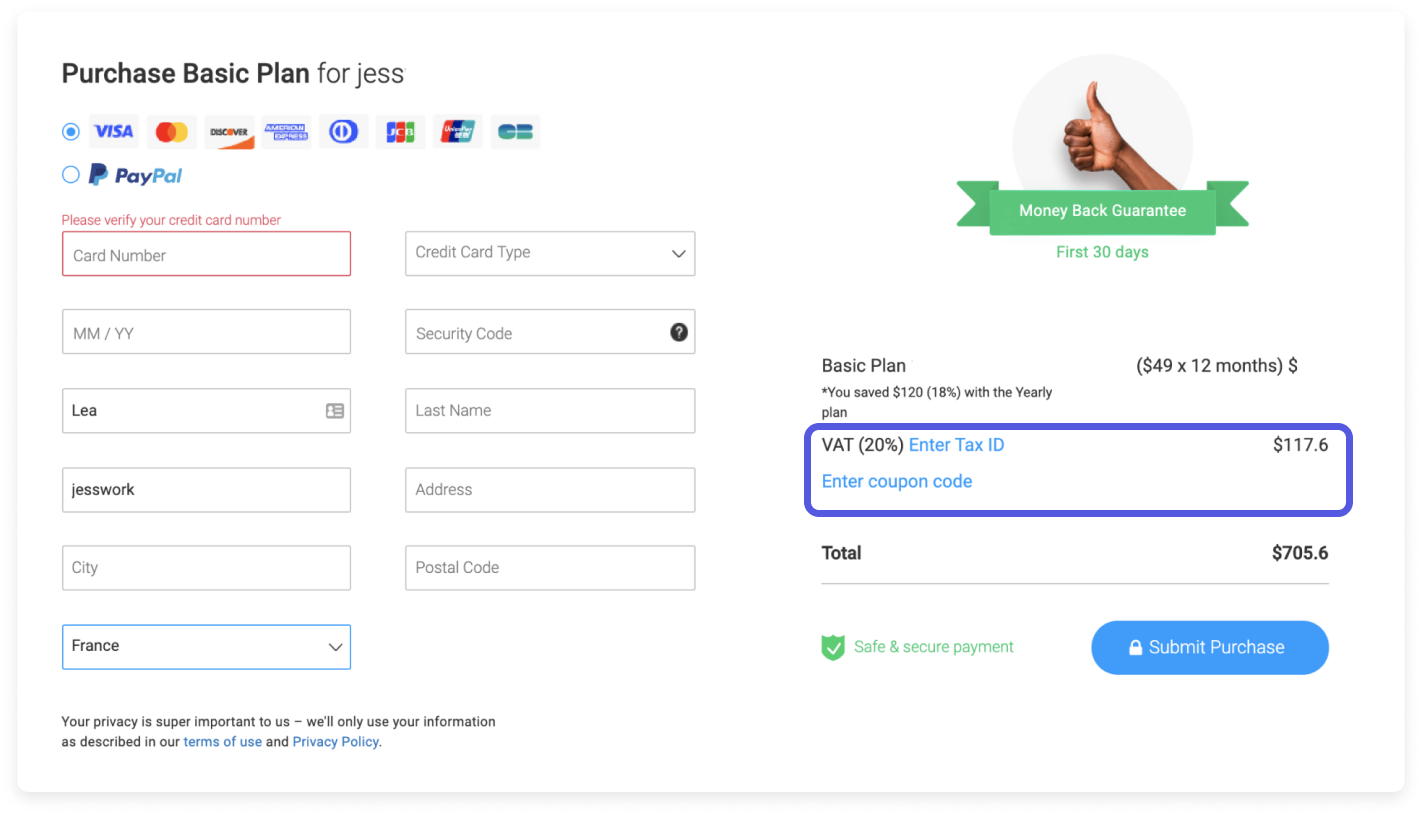

Whenever you purchase a monday.com subscription, you have the option to add your VAT ID prior to the payment so you won't get charged. Those in Australia and India will see GST instead of VAT.

In case you forgot and were still charged tax, you can add your VAT number directly in the Billing section in order to apply this to future invoices as well as to prompt a VAT refund on applicable charges. If you have any trouble, you can always reach out to us for help by using our contact form. 😊

If you have any questions, please reach out to our team right here. We’re available 24/7 and happy to help.

Comments